Our honorable Jurors for 2021

Adeline Tan FIA

Adrian Chan

Agnes Tai

Alan Chan

Alexandra Tracy

Alvin Ma

Alvin Poh, CFA, CAIA, CFTe

Andrea Webster

Anthony Cheung

Arjan De Boer

Arun R. Kelshiker, CFA, CAIA

Belinda Hsieh

Belle Liang

Bryan Goh

Catherine Chen

Chiong Kong Chan

Chris Ryan

Dr. Christophe Faugère

Clement Lai

Colin Low

Elsa Pau

Gilbert Heng

Greg Hargrave

Janet Li, CFA

Jaye Chiu

Jessica Broomhall

Joanne Murphy, CAIA

Jonathan Wan

Katy Yung

Larry Cao, CFA

Leo Lee

Leonie Kelly

Loretta Ng

Mah Ching Cheng, CFA

Mahesh Harilela

Maria Tsui

Marie-Anne Kong

Martin W. Hennecke, St. James Place

Michael Au

Nicholas Leung

Nick Pollard

Paul Smith, CFA

Paula DiPerna

Peter Ryan-Kane CFA

Philip Niem

Ronald W. Chan

Simon Liu

Stephan Repkow

Stephanie Choi

Wong Meng Keet

Wyman Leung

Yuni Choi

The Gatekeeper Forum

The Gatekeeper Forum is a sub-set of the judging process with four to six jurors holding a two-way conversation with the manager of a contesting strategy. The forum allows the contestants’ CIO or Portfolio Manager to showcase how they’re running a profitable strategy and respond to technical questions raised by the gatekeepers.

The Forum is a highly curated platform that connects both the buy and sell-side of funds and empowers gatekeepers from Private Banks, Institutions, Foundations, Single and Multi-Family Offices to look under the hood before they invest. Another purpose of The Gatekeepers’ Forum is to promote investment clarity and transparency. The interaction between senior fund house representatives and our jurors can reveal the underlying idea generation and philosophy of the contesting strategies from multiple perspectives, particularly from a qualitative and ESG perspective. Participants who are present at the forum receive Level III scoring points. Each juror has up to 10 points to allocate to each participant. Only invited jurors can select the sessions they are interested in. The forum was held virtually last year, with managers and jurors joining all over the world.

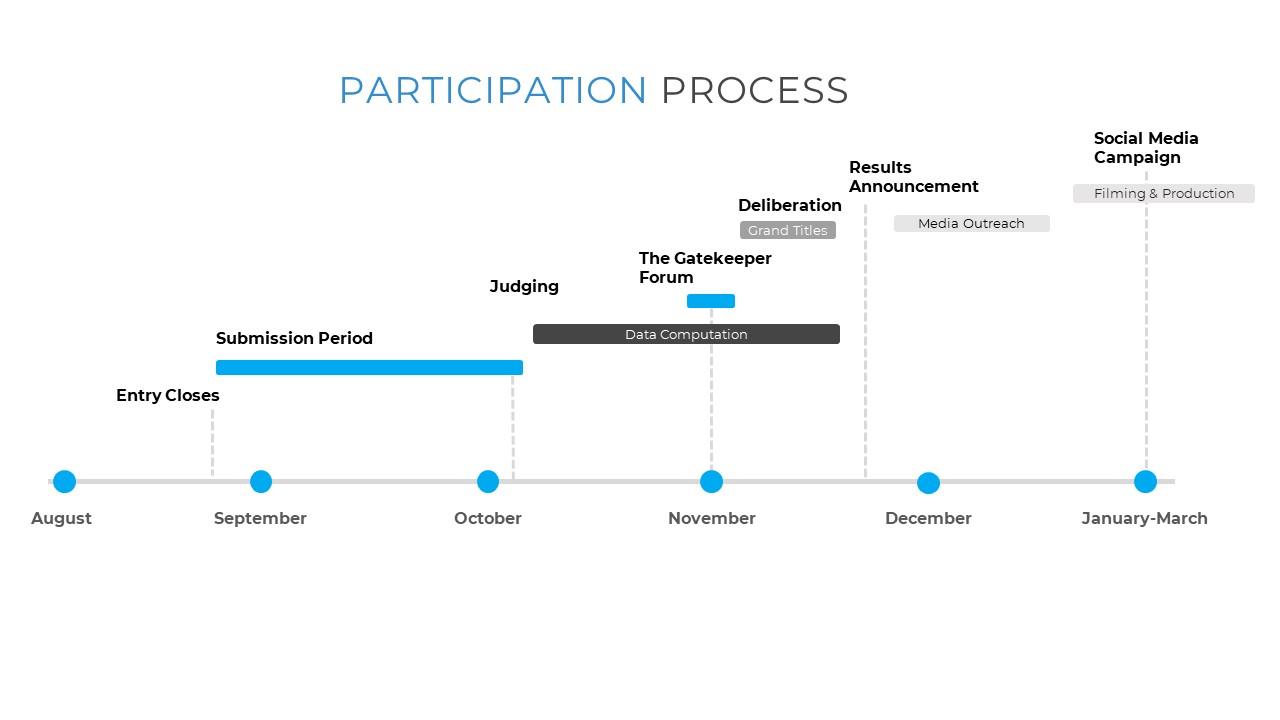

Key Dates

| Submission Activities: | Key Dates: |

|---|---|

| Entry Opens: | October 11, 2022 |

| Close of Entry: | November 10, 2022 |

| Submission Deadline for Shortlisting (Level 1): | December 5, 2022 |

| Submission Deadline for Shortlisted Candidates (LevelI): | December 23, 2022 |

| The Gatekeeper Forum: | January 16-18, 2023 |

| Judging Period: | January 2023 |

| Results Announcement: | February 9, 2023 |

| Filming (completion by 1 May 2023): | Subject to Client Schedule |

Enter in 3 Simple Steps:

irst, decide on which investment strategies you would like to put forward. It could be something you take considerable pride in or an offering you want a candid assessment on by gatekeepers, fund selectors, and asset owners. You might consider registering these strategies for one or multiple jurisdictions: Hong Kong, Taiwan, and Singapore.

Second, click the “Enter Now” button and select the appropriate categories (investment strategies) and the jurisdiction/s you’re competing in – Hong Kong, Taiwan, Singapore, or a combination of these.

After confirming your registration, you will receive a link to the online submission portal to answer the Benchmark questionnaire and submit attachments to substantiate your responses. The questionnaire is structured according to 5 pillars which the judging panel and we consider to be key indicators of high-quality asset management:

-

-

-

- Investment approach;

- Portfolio Management;

- Performance & Risk;

- Stewardship;

- Corporate Quality.

-

-

Fees

| ENTRY OPTIONS | FEES | |

|---|---|---|

| BEST VALUE - Special BlueOnion Membership Offer: 1. Unlimited House Awards Entries 2. Full Access to the BlueOnion Fund Hub platform containing Sustainability and Quantitative data to over 180,000 funds for one full year 3. Unlimited download of a Sustainability Report for the funds entered into the competition for one full year 4. Attending the Gatekeeper Forum | • Flat Fee for House Awards Categories: USD 3,500 per Region • Non-House Awards Categories: USD 980 per Category/per Region |

|

| Non-BlueOnion Members: • Attending the Gatekeeper Forum | • USD 980 per Category per Region |

The Benchmark Sustainable Wealth Forum is a knowledge exchange where industry leaders and winners of the Benchmark awards are featured. The Forum covers the financial eco-system and discovers the inside out of the providers’ practices that lead to a more sustainable industry through responsible and ethical investing in protecting the investors across multiple generations. The inaugural series covers the Winners at the Benchmark Wealth Management Awards and the Benchmark Fund of the Year Awards 2020. The topics covered in the Asset Management Series include Investment Propositions, Sustainability, and ESG approaches, Investor Protection, and Global Opportunities and Risks.

Between March and May of this year, we have helped seven winning companies gain over 200,000 impressions per interview on LinkedIn and Facebook with an average engagement rate of 3.16% compared to the market average of 2%.